Introduction:

The Financial Independence Retire Early (FIRE) movement has gained traction globally, offering individuals a roadmap to achieve financial freedom and retire early. In this article, we will explore how realizing homeownership dreams plays a pivotal role in the FIRE journey, focusing on mortgages, real estate, and strategies to expedite the path to financial independence.

Realizing Homeownership Dreams in the FIRE Movement:

For many pursuing FIRE, homeownership is a significant goal. Owning a property can provide stability, reduce living costs in retirement, and serve as a valuable asset. Let’s delve into the key aspects of realizing homeownership dreams within the context of the FIRE movement.

Mortgages as a Strategic Tool:

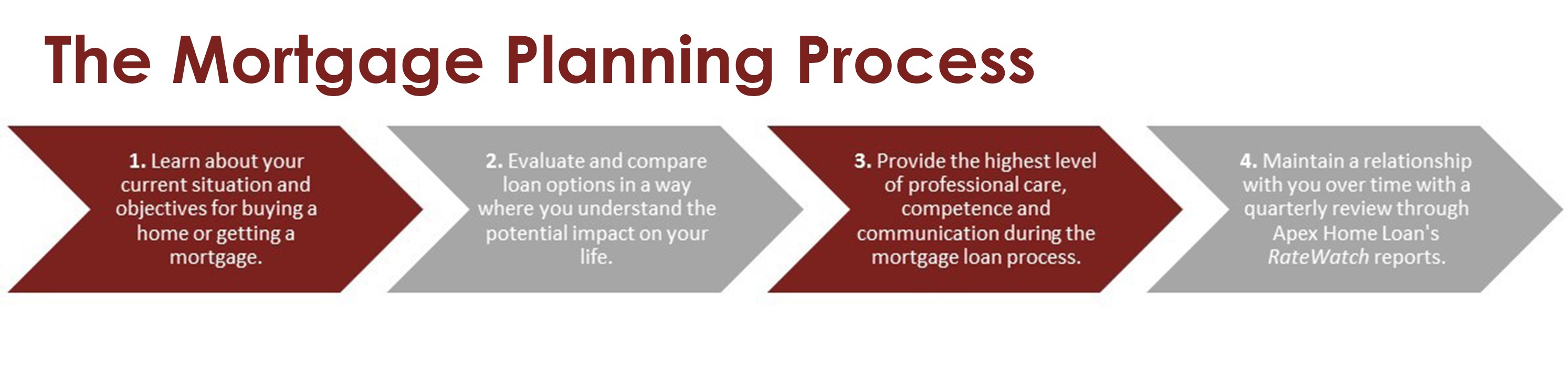

- Strategic Mortgage Planning: When pursuing FIRE, strategic mortgage planning is essential. Consider mortgage options carefully, aiming for terms and rates that align with your financial goals. Some FIRE enthusiasts prefer aggressive mortgage repayment, while others leverage low-interest rates to maximize investment returns.

- Accelerated Mortgage Payments: For those aiming to retire early, accelerating mortgage payments can be a powerful strategy. Making extra payments towards the principal reduces the overall interest paid over the life of the loan and shortens the mortgage term, bringing you closer to a mortgage-free retirement.

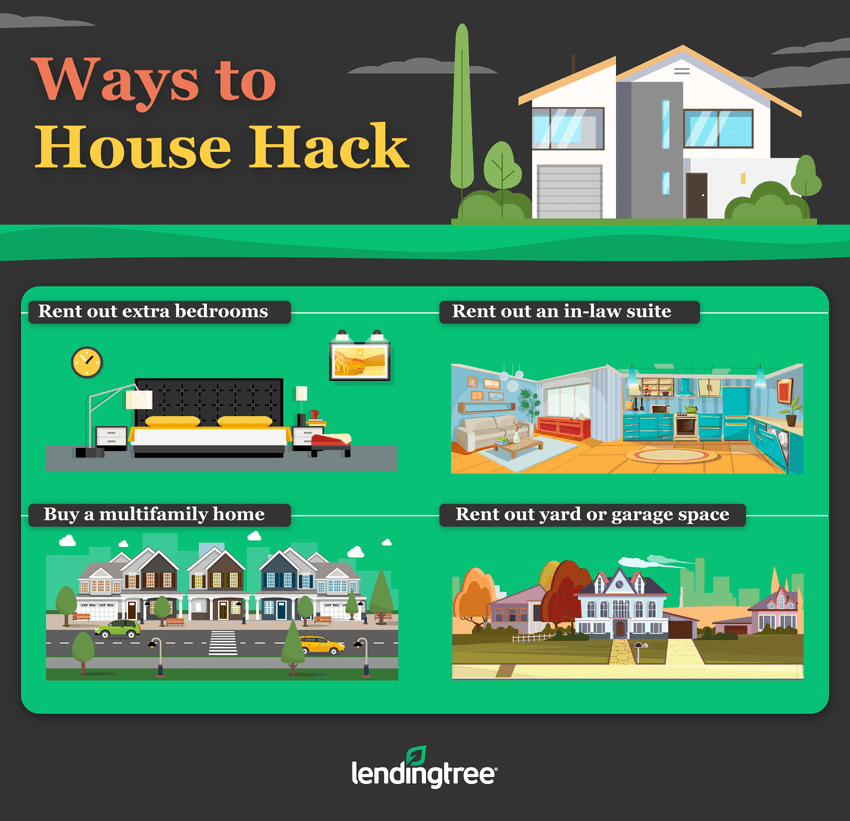

- House Hacking for FIRE: House hacking, a concept embraced by many in the FIRE community, involves generating rental income from your primary residence. This can offset mortgage costs, accelerate mortgage payoff, and contribute to overall financial independence.

Real Estate as an Asset in the FIRE Journey:

- Strategic Real Estate Investments: Integrating real estate into your FIRE strategy goes beyond homeownership. Strategic real estate investments, such as rental properties, can generate passive income streams, accelerating your journey to financial independence.

- Location and Cost Considerations: Choosing the right location and being mindful of costs are crucial when realizing homeownership dreams in the FIRE movement. Opt for areas with a favorable cost of living, lower property taxes, and potential for property appreciation to enhance your overall financial picture.

- Downsizing for FIRE: Downsizing your home as part of your FIRE plan can free up equity and reduce ongoing expenses. A smaller, more cost-effective residence contributes to increased cash flow, providing financial flexibility during retirement.

Strategies to Accelerate FIRE through Realizing Homeownership Dreams:

- Aggressive Savings for Down Payment: Saving aggressively for a substantial down payment can lower mortgage amounts and associated interest costs. Consider adopting a frugal lifestyle to boost savings and expedite the realization of homeownership dreams within the FIRE timeline.

- House Hacking for Early Retirement: House hacking, beyond mortgage considerations, involves leveraging your living space for income. Consider renting out spare rooms or utilizing additional living spaces to generate rental income, which can significantly impact your FIRE timeline.

- Optimize Tax Advantages: Understanding and optimizing tax advantages related to homeownership is crucial. Explore potential tax benefits, such as mortgage interest deductions, and leverage them to enhance your overall financial strategy within the FIRE framework.

Conclusion:

Realizing homeownership dreams is a crucial element of the Financial Independence Retire Early (FIRE) movement. By strategically approaching mortgages, exploring real estate investments, and adopting creative strategies such as house hacking, individuals can accelerate their path to freedom and early retirement. Embrace the principles of FIRE, integrate homeownership goals into your financial plan, and let the realization of your real estate dreams become a catalyst for financial independence and an early retirement filled with freedom and choice.

Leave a Reply