Introduction:

In the ever-evolving landscape of financial markets, diversifying investments is a critical strategy for building a robust portfolio. This article explores the importance of diversification, strategies for implementing it, and how understanding economic indicators plays a crucial role in navigating the complexities of financial markets.

Understanding Diversification:

- Diversification Defined: Diversification involves spreading investments across various asset classes, sectors, and geographic regions to reduce risk. The primary goal is to optimize returns while minimizing the impact of volatility in any single investment

- Balancing Risk and Return: Different asset classes, such as stocks, bonds, real estate, and commodities, carry varying levels of risk and return potential. Balancing these elements based on an investor’s risk tolerance and financial goals is essential for effective diversification.

- Benefits of Diversification:

- Risk Reduction: Diversification helps mitigate the impact of poor performance in one asset class by offsetting it with positive performance in others.

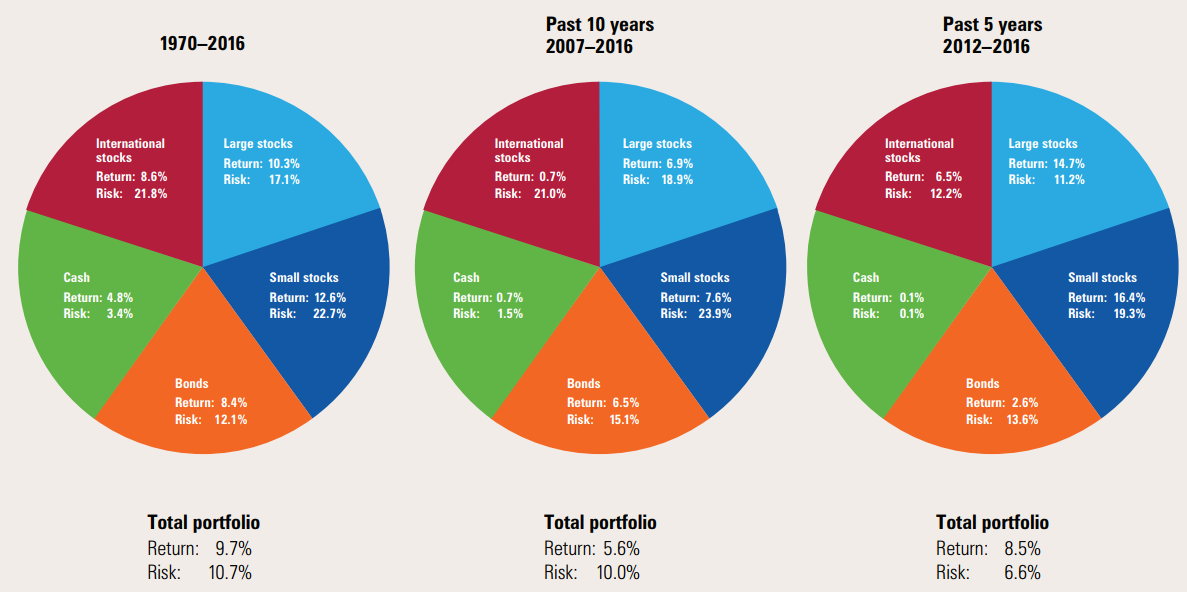

- Smoother Returns: A well-diversified portfolio may experience less volatility, leading to more stable and predictable returns over time.

- Opportunity for Growth: Exposure to different market segments increases the potential for capturing growth opportunities as they arise.

Strategies for Diversifying Investments:

- Asset Class Diversification:

- Allocate investments across different asset classes, including equities, fixed income, real estate, and alternative investments.

- Adjust the weightings based on your risk tolerance, time horizon, and investment objectives.

- Sector Diversification:

- Within each asset class, diversify further by investing in various sectors. This approach helps reduce the impact of poor performance in a specific industry.

- Consider sectors such as technology, healthcare, finance, and consumer goods to achieve a well-rounded portfolio.

- Geographic Diversification:

- Invest in a mix of domestic and international assets to reduce exposure to regional economic risks.

- Consider global economic indicators and geopolitical factors when making decisions about geographic diversification.

- Investment Style Diversification:

- Diversify across different investment styles, such as growth, value, or income-focused strategies.

- Each style responds differently to economic conditions, providing additional layers of diversification.

- Risk Parity Strategies:

- Explore risk parity strategies that allocate investments based on risk rather than traditional market capitalization.

- These strategies aim to balance risk contributions across asset classes for a more stable portfolio.

Understanding Economic Indicators:

- Key Economic Indicators:

- Familiarize yourself with essential economic indicators such as GDP growth, unemployment rates, inflation, and interest rates.

- These indicators provide insights into the overall health of the economy and can influence investment decisions.

- Monitoring Market Sentiment:

- Pay attention to market sentiment indicators, including consumer confidence and investor sentiment.

- Changes in sentiment can impact market dynamics and influence asset prices.

- Interest Rate Trends:

- Understand the implications of interest rate trends on various asset classes, especially bonds and real estate.

- Central bank decisions and interest rate movements can have a profound effect on investment returns.

- Inflation Considerations:

- Consider the impact of inflation on purchasing power and investment returns.

- Certain assets, like commodities and inflation-protected securities, may perform well in inflationary environments.

- Global Economic Trends:

- Stay informed about global economic trends, as they can impact international investments and currency values.

- Monitor geopolitical events and their potential impact on financial markets.

Navigating Financial Markets with a Diversified Portfolio:

- Regular Portfolio Reassessment:

- Periodically reassess your portfolio to ensure it aligns with your financial goals and market conditions.

- Adjust the allocation based on changes in economic indicators and market trends.

- Professional Guidance:

- Seek advice from financial professionals who can provide insights into current economic conditions and recommend adjustments to your portfolio.

- Financial advisors can help tailor a diversified strategy based on your individual circumstances.

- Staying Informed:

- Continuously educate yourself about economic indicators, market trends, and emerging investment opportunities.

- Stay informed through reputable financial news sources and market analyses.

Conclusion:

Diversifying investments is a cornerstone strategy for building a robust financial portfolio in dynamic markets. By implementing various diversification strategies across asset classes, sectors, and geographic regions, investors can manage risk effectively and position themselves for long-term success. Understanding key economic indicators is equally important for making informed investment decisions and navigating the complexities of financial markets. Through a well-diversified portfolio and a keen awareness of economic factors, investors can optimize returns, minimize risk, and adapt to changing market conditions with confidence.

Leave a Reply